Hiring a property manager can be a very rewarding investment to support your real estate goals while making the workload much easier for you. When you work with a property management company, you are trusting them to take care of major aspects of the rental property, including advertising the space, signing new leases, interviewing prospective tenants, providing maintenance, collecting rent, and many others. A major responsibility of a property manager is managing tenant and owner funds. To ensure a good owner-manager relationship, it’s important to have transparency in how a property management company handles funds. The requirements and details should be clearly outlined in an initial management contract to ensure accountability and trust between both parties.

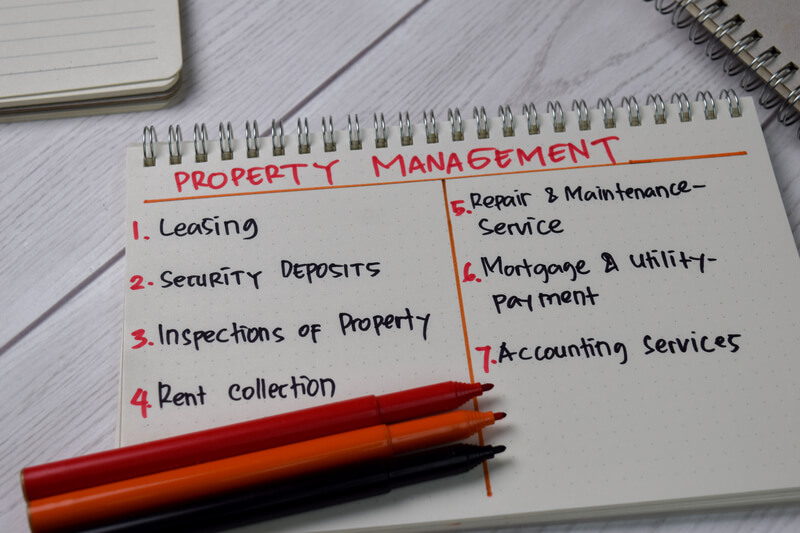

Here’s how property managers properly handle tenant and owner funds:

Security Deposits

Security deposits are paid to the property manager, with the promise of it being returned after the lease if the property remains in the same condition with normal wear and tear. They are considered a standard tool to motivate tenants to care for the space and can be used to offset damages that the renter causes to the property.

The property management company should be specific about where security deposits are stored in the initial contract. In Alberta, all security deposits must be put in an interest-bearing trust account in a bank, treasury branch, credit union or trust company in Alberta within 2 banking days of the time they are collected from the tenant. The government of Alberta also limits security deposit amounts to one month’s rent at the time the tenancy begins.

Rent Payments

Property managers receive rent payments from the tenants, which are then sent to the owner. The property managers must follow the terms stated in the management contract, including exactly which day of the month the payments are forwarded to the owner, and which method of transfer will be used.

Expenses

Managing a property often includes hiring third-party contractors or companies for various services. For example, the property manager usually hires an outside contractor for repairs and maintenance. Whenever expenses are made, the property manager has to accurately record all financial transactions.

Tracking with software

To help with financial management and accuracy, property managers use property management software to meticulously track all funds for each property. This provides a clear trail of all money that comes in and out, ensuring peace of mind for everyone involved. The software can also provide accurate monthly financial statements and reports so rental property owners can know how their business is doing.

When you invest in the services of good property managers, you are trusting that they will oversee all aspects of the rentals, including tenant and owner funds. The right property management company will have clear policies in writing for the benefit of everyone involved. For a property management company in Calgary with decades of experience in trusted fund management, contact GIL Property Management & Sales today to get started!